- Australia and New Zealand

- East Asia and the Pacific

- Europe and Central Asia

- Albania

- Armenia

- Austria

- Azerbaijan

- Belarus

- Belgium

- Bosnia and Herzegovina

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Georgia

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Kazakhstan

- Kyrgyz Republic

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Poland

- Portugal

- Romania

- Russian Federation

- Serbia

- Slovak Republic

- Slovenia

- Spain

- Sweden

- Switzerland

- Turkey

- Ukraine

- United Kingdom

- Uzbekistan

- Latin America and the Caribbean

- World Economic Outlook, IMF.

- The World Bank

- Global Findex Database, 2013

- HOFINET data.

- Nigeria’s Central Bank Leads Housing Finance Sector Reform

- Renewed Commitment by Members of the African Union for Housing Finance

- Nigeria’s Central Bank Approves Framework for a Mortgage Refinance Company

- Government of South Africa Moves to Protect Consumers and Assist Over-Indebted Households

- Nigerian Mortgage Refinancing Company Open For Business

- Kenya Approves Bill to Cap Interest Rates

Home > Countries > Sub-Saharan AfricaSub-Saharan Africa

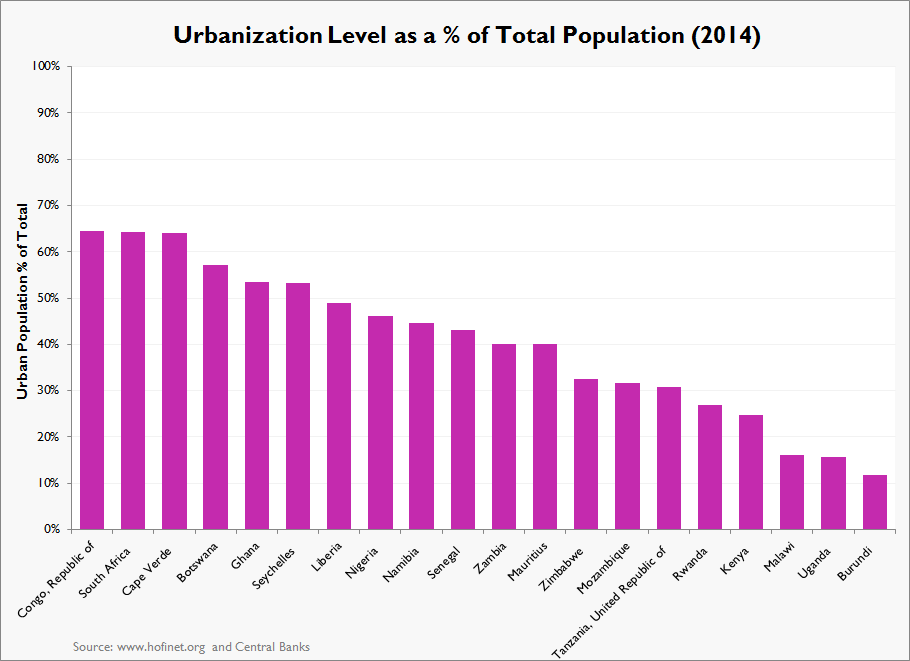

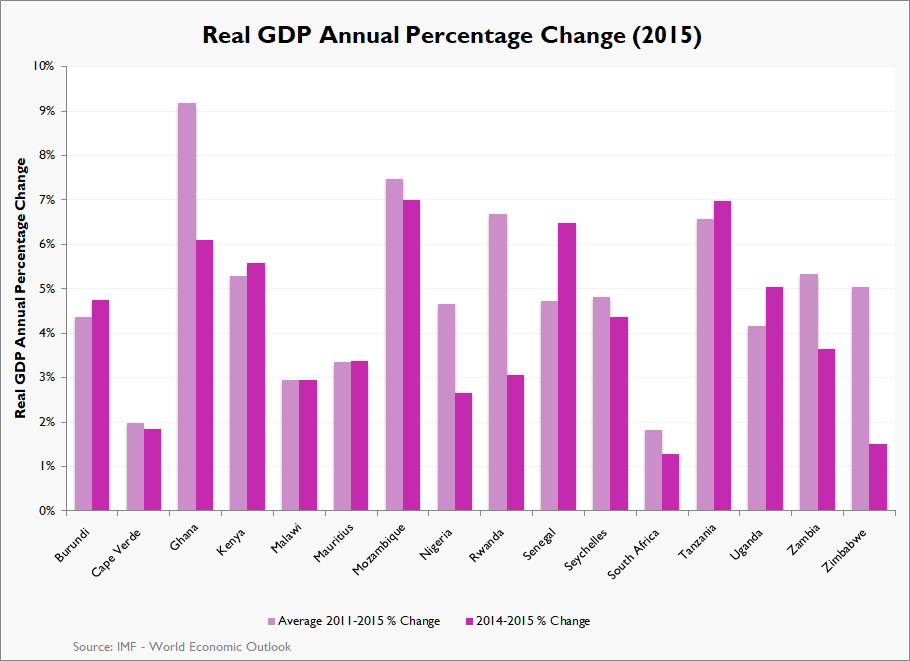

Sub-Saharan Africa is among the world’s fastest growing regions with a GDP growth of 4.7 percent in 2013, compared to 3.7 percent in 2012.1 Robust growth was seen in Nigeria,Ghana, Liberia,Mozambique,Tanzania,and Zambia.Nigeria’s GDP growth increased to 5.4 percent from 4.27 percent in 2012, while South Africa’s growth rate decreased to 1.9 percent in 2013, down from 3.6 percent in 2011.1 Importantly,GDP per capita in current USD has grown in all of Sub-Saharan Africa,with the exception of South Africa and Cape Verde.A steady decrease of the average inflation rate, from 10.1 percent in 2011 to 6.07 percent in 2013, is another positive economic indicator.1 Sub-Sahara’s urbanization level was 37 percent of total population at the end of 2013; only South Africa, Botswana and Cape Verde have urbanization levels above 60 percent.2

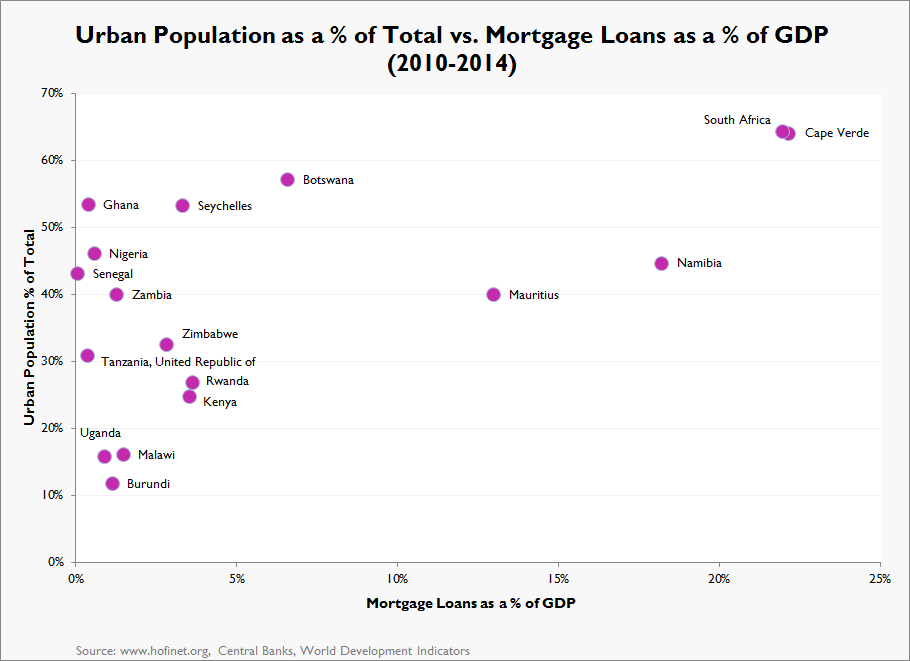

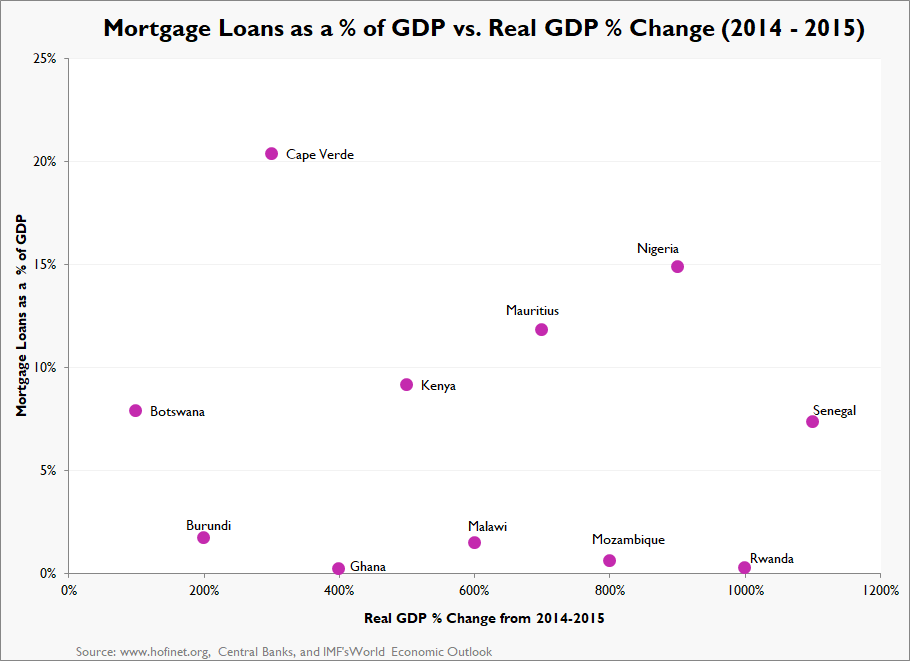

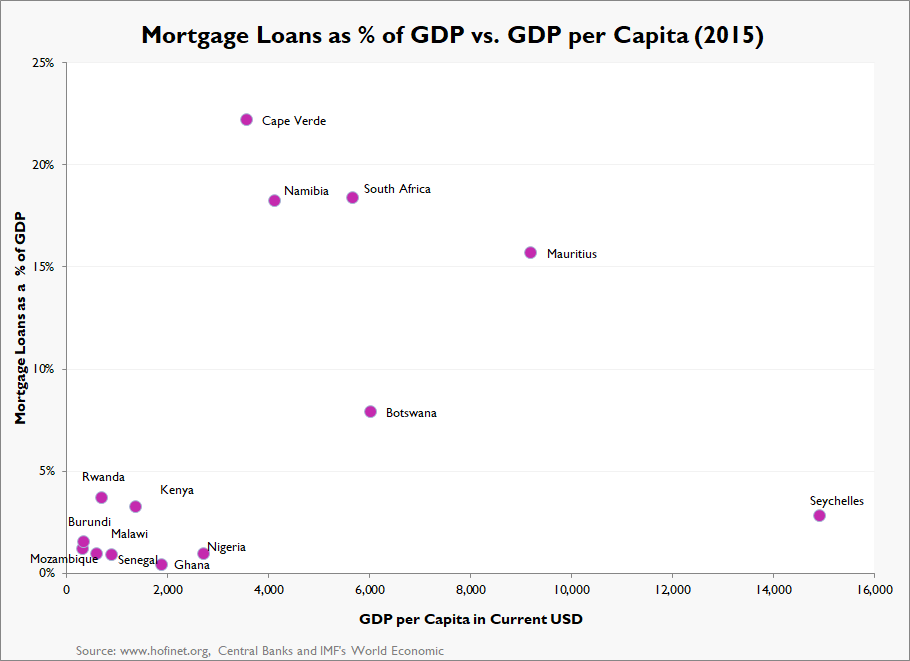

However, with 48.5 percent of the population living on less than $1.25 a day, Sub-Saharan Africa is still the poorest region in the world. Persistent low-income levels and poor access to financial services, have resulted in an extremely low percentage of adults that have credit outstanding – only around 5 percent of adults as of 2011.3 Housing finance in Sub-Saharan Africa is still at a very nascent stage. The amount of mortgage loans outstanding for the region was below 5 percent of GDP at the end of 2013. South Africa, Cape Verde and Namibia are the only countries with a mortgage sector larger than 17 percent of the GDP. Maximum Loan to Value ratios (LTV) for mortgages average 80 percent for the region, with only two countries exceeding that ratio -- South Africa and Cape Verde allow LTVs as high as 100.

Financial institutions depend on customer deposits as the main source of funding for their mortgage portfolios. Lack of access to longer-term funds and institutional and legal constraints such as difficulties in obtaining title registration on properties and cumbersome eviction procedures in case of default, have all restrained the growth of the mortgage sector. The perceived high credit risk, high transaction costs and the lack of competition in the banking sector in most Sub-Saharan African countries have resulted in high margins and extremely high interest rates for mortgages, reaching upwards from 25 percent in some countries.4

In addition, very few financial institutions have developed non-collateralized loan products for housing. The products that are offered carry extremely high interest rates and have a short term, making them only feasible for gradual construction and home improvement.

There are, however, positive signs as well, including the establishment of the Nigeria Mortgage Refinance Corporation (NMRC) in 2014, and the reform of the Tanzania Mortgage Refinance Corporation. South Africa is beginning to address constraints in the expansion of its lower-middle income housing and mortgage market through reforms of its subsidy system. These efforts are critical in order to address the growing demand for urban housing.Sources:

RELATED LINKS:

African Union for Housing Finance

FinMark Trust

AUHF Annual Conference

Centre for Affordable Housing in Africa

2020 Yearbook: Housing Finance in AfricaRegional Documents:

Recent Updates

Copyright © 2024. HOFINET. By using or accessing this website, you signify that you agree to the Terms of Use.

When using or citing any information displayed on this website or accompanying blog sites, you must provide a reference to HOFINET.